LendingPoint considers own financial loan applicants with good credit history, but you might have to pay for higher interest premiums and charges that would eat into your initial financial loan amount. There’s also an earnings need to qualify, and cosigners aren’t allowed.

Shopper Working experience Lenders that acquire significant marks Within this group offer online programs, have different shopper guidance choices and permit a co-borrower.

It’s very well worthy of your time and energy so as to add up the full price of Every single bank loan provide. This move makes sure you’re generating an knowledgeable selection that aligns using your economic objectives.

Most often, it is possible to repay a $5,000 personal loan early. Just before signing on to a personal loan you need to be sure there's no early payoff penalty. If there's no early payoff penalty, you should not be penalized or charged further for paying the loan off early.

David Gregory is definitely an editor with a lot more than a decade of experience inside the fiscal services business. Just before that, he worked as a toddler and spouse and children therapist till he designed the decision to move overseas for several many years to operate and journey.

If you take for a longer period than the advertising interval to pay the principal in comprehensive, you could have a larger loan Value than envisioned. Alternatively, personalized loans can finance one particular-time buys such as appliances or home furniture. Though it’s enticing to keep cost savings intact or get what you will need without the need of cash up-front, do your research and make clever monetary selections.

Credit card debt Consolidation: Financial debt consolidation financial loans can combine numerous credit cards or debts into 1 loan. Prior to continuing which has a credit card debt consolidation mortgage, ensure the costs make sense, and it'll in fact expedite the street to starting to be debt-totally free or decreasing personal debt.

With prequalification in hand, it’s time to match financial loan gives from distinct lenders. Appear beyond just the desire fees and regular monthly payments. Look at components like repayment term (how much time You should spend again the financial loan), prepayment penalties and any further fees.

MarketWatch Guides may get payment from firms that appear on this page.

The compensation may impression how, exactly where As well as in what get merchandise show up, but it does not affect the recommendations the editorial staff gives. Not all businesses, products and solutions, or delivers were being reviewed.

For those who have truthful credit rating, having authorized for a personal loan and making on-time payments can move you towards owning good credit.

LendingUSA is finest for just one-time purchases or works by using, for instance cosmetic surgical procedure funding, pet financing, funeral funding, and a lot more. LendingUSA gives financial loans for a variety of industries. Loans is usually acquired through the LendingUSA Web page or through a service provider companion that refers to LendingUSA.

But it can be hard to demonstrate your revenue in case you don’t Have a very W2. Even if you’re unemployed, getting a loan can be done, but the applying course of action may possibly just take more time.

Considering the fact that You might also want to think about cash equivalents for price savings targets less than three decades absent, these choices can operate properly for unexpected emergency more info savings and small-term cost savings aims:

A very good credit score may help you protected a decreased interest amount and better bank loan phrases. A very good to Great credit history score ranges from 670 to 799, In line with FICO.

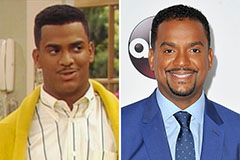

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!